- DevvStream Holdings Inc. (NEO: DESG) to uplist to Nasdaq via merger with Focus Impact Acquisition Corp. (NAS: FIAC)

- DevvStream helps monetize carbon credits with focus on technology-based solutions such as electric buses and more efficient HVAC systems

- Tech solutions inherently easier to quantify than nature-based solutions like tree or mangrove planting

- DevvStream’s system designed to prevent questionable “junk” credits from changing hands

- 1st pure-play carbon credit generator listed on Nasdaq, with requisite transparency and controls

- Blockchain technology ensures transparency and accuracy of credit count plus scalability

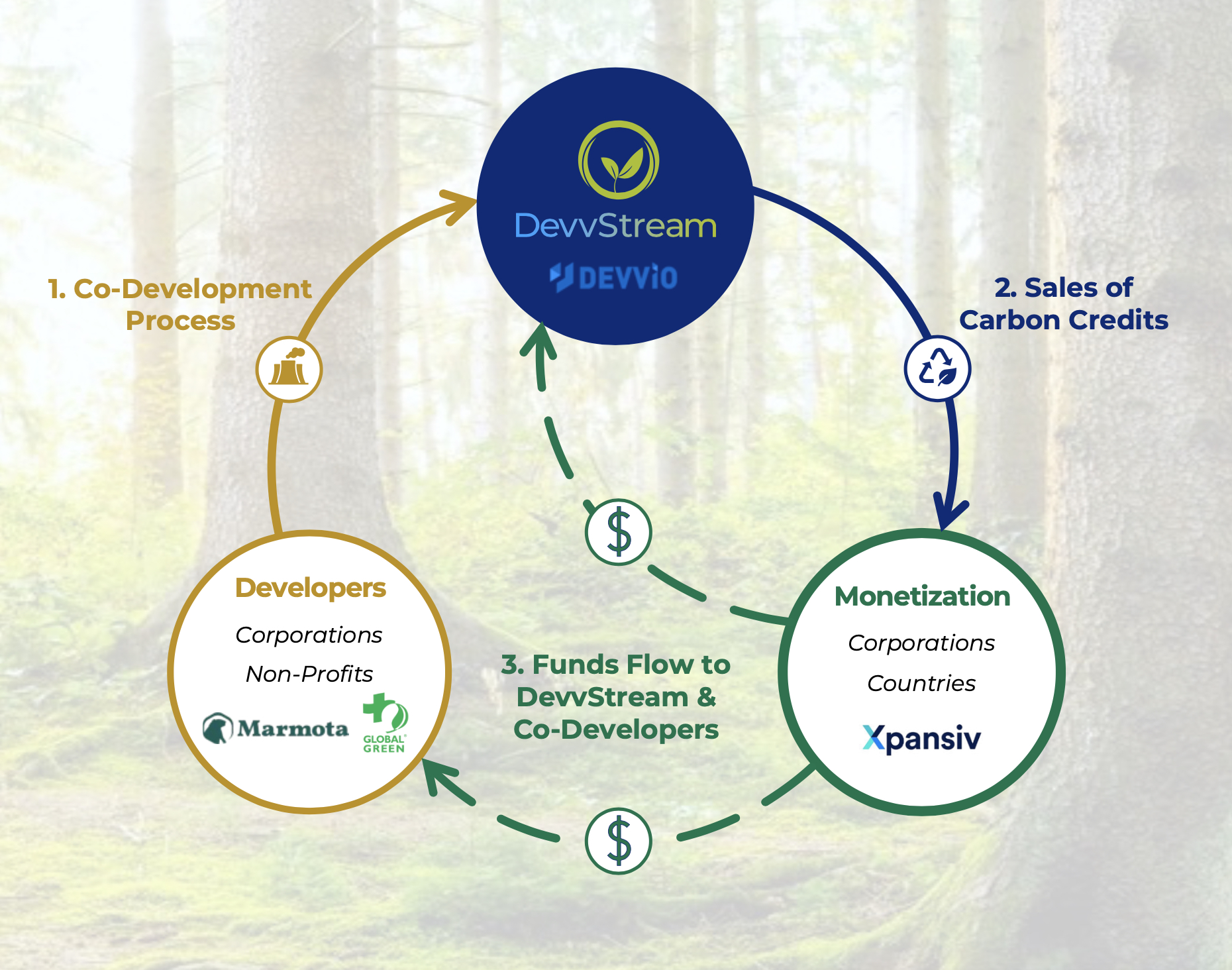

- DevvStream helps clients create, authenticate and sell credits to end customers like companies and governments

- Partners include Ryoden Corp., part of Mitsubishi Electric Corp., that provides high efficiency HVAC systems

- Contracts are long-term, running 10 years or more

- DevvStream is capital light with extremely high Ebitda margins, north of 80% in 2025

- Trades at a steep discount to peers, roughly 5x 2025 Ebitda vs. NextEra Energy Inc. at 11.5x and Brookfield Renewable Corp. at 10.9x

By John Jannarone, Jarrett Banks and Karen E. Roman

Countries and giant corporations around the world have made bold pledges to reduce emissions dramatically in coming years and decades, but they’re likely to need the help of carbon credits to get there. The big challenge: Finding a carbon credit developer who can be trusted.

Meet DevvStream Holdings Inc. (NEO: DESG), which plans to uplist to Nasdaq via merger with Focus Impact Acquisition Corp. (NASDAQ: FIAC), a SPAC that raised money to find a target that achieved social as well as financial objectives. Once the deal closes, current DevvStream shareholders are expected to own the majority of the only U.S. publicly-listed carbon credit co-developer.

To appreciate DevvStream’s opportunity, it’s first important to assess the challenges of carbon credits. There’s no doubt the market has tremendous potential, with global traded value forecast to grow 18% annually from $979 billion in 2022 to $2.7 trillion in 2028, according to American University’s School of International Service. That volume is needed to achieve goals set by large countries as well as traditionally pollutive industries like oil and airlines that can buy credits to offset their own emissions.

Unfortunately, many carbon credits have been the subject of an abuse known as Greenwashing, when they turn out not to reflect true emissions reductions. A recent study in the journal Science found that just 6% of offsets were linked to additional carbon reductions in sample set of forestry-focused projects. Major corporations with extensive carbon reduction targets including Nestlé S.A. and British Airways Plc were seen as exposed. Even comedian John Oliver dedicated a segment to the issue on Warner Bros. Discovery, Inc.’s HBO.

The good news is that DevvStream approaches carbon credits largely from a different angle that dramatically reduces the risk of “junk” credits being created. Unlike re-forestation projects or planting mangroves, DevvStream zeroes in on technology-based credits. Typical examples include fleets of electric buses and energy efficient HVAC systems, such as one made by Ryoden Corp., part of Mitsubishi Electric Corp., which has partnered with DevvStream.

Such tech-based credits are easier to measure accurately than, say, a reforestation project that could be impacted by anything from fires to termites. DevvStream also always uses third parties to validate credits to ensure objective assessments are made (some other participants validate internally, which creates obvious risks).

Another differentiator investors should study is a blockchain-based system called DevvX, which is operated by sister company Devvio. DevvX is the world’s lowest carbon footprint blockchain and uses one million times less energy than Bitcoin per transaction.

That platform should help the company’s profits grow very quickly thanks to minimal incremental cost per transaction. It shows up in DevvStream’s financials: The company expects Ebitda to rise from $6.7 million next year to $45.1 million in 2025, when it will command a margin north of 80%.

Turning to valuation, the deal has been priced to work. Based on the current share price of roughly $10.80, DevvStream effectively trades at just 4.7x 2025 Ebitda vs. NextEra Energy Inc. at 11.5x and Brookfield Renewable Corp. at 10.9x.

The company also bolstered its balance sheet with a recent announcement it would raise interim financing of $7.5 million via a convertible note offering. While DevvStream benefits from an asset-light business model, the fresh capital will help expand its operational footprint and more rapidly convert its pipeline of over 140 projects. The notes carry a high currently yield and convert to shares of the company at a discount upon close.

For many of DevvStream’s customers, the partnership is a clear win because they simply weren’t monetizing credits at all beforehand. But given DevvStream’s low capex needs, both the company and the client can enjoy plenty of financial benefit once the credits are sold.

Competition, for now, is minimal and it would take some time for would-be rivals to enter the fray. With contracts lasting 10 years or more, DevvStream should be able to lock in a healthy client base long before any serious challenger emerges.

Of course, DevvStream isn’t opposed to natural carbon solutions and has protections in place ensure they succeed. The company has an MOU with Bluegrace Energy, making it the exclusive carbon credit manager for an 8.3 million-hectare Amazon rainforest conservation project in Bolivia. DevvStream plans to use advanced technology like AI, machine learning and satellite imaging to ensure accurate carbon credit quantification, addressing co-called Core Carbon Principles. The project aims to protect land and support indigenous communities with initiatives like infrastructure, education and healthcare.

There’s also a trusted hand at the helm with CEO Sunny Trinh, who can boast 25 years of experience in the technology and carbon markets. He also has plenty of public company experience before leading DevvStream, including senior roles at Avnet (NASDAQ: AVT) and Arrow Electronics (NYSE: ARW) where he worked with dozens of companies in renewable and energy efficiency technologies.

Finally, DevvStream should get a lift from some Hollywood star power, thanks to partnerships with some of the most famous environmental advocates in the world. Megan Fox, Dr. Jane Goodall and Robert Redford are serving as ambassadors for the Buildings and Facilities Carbon Offset Program (BFCOP), created by DevvStream and a NGO called Global Green. BFCOP simplifies carbon credit generation from energy-efficient and renewable energy projects in U.S. and Canadian buildings. It’s a critical step in addressing the substantial carbon emissions from buildings, which account for 40% of global energy-related emissions. The program aims to reduce building carbon footprints and has attracted high-profile support from the ambassadors.

With a big head start over would-be rivals, a solid and growing pipeline with long-term contracts, DevvStream has a bright future. And as worries over greenwashing and empty ESG promises abound, a trusted operator will stand out from the pack. Investors should see DevvStream’s uplisting as a green light to extend its lead.

Contact:

Twitter: @IPOEdge

Instagram: @IPOEdge

—