- Newly-listed PSQ Holdings, Inc. (NYSE: PSQH) expects to swing to cash flow positive in 2024; has $32.6 million cash on balance sheet

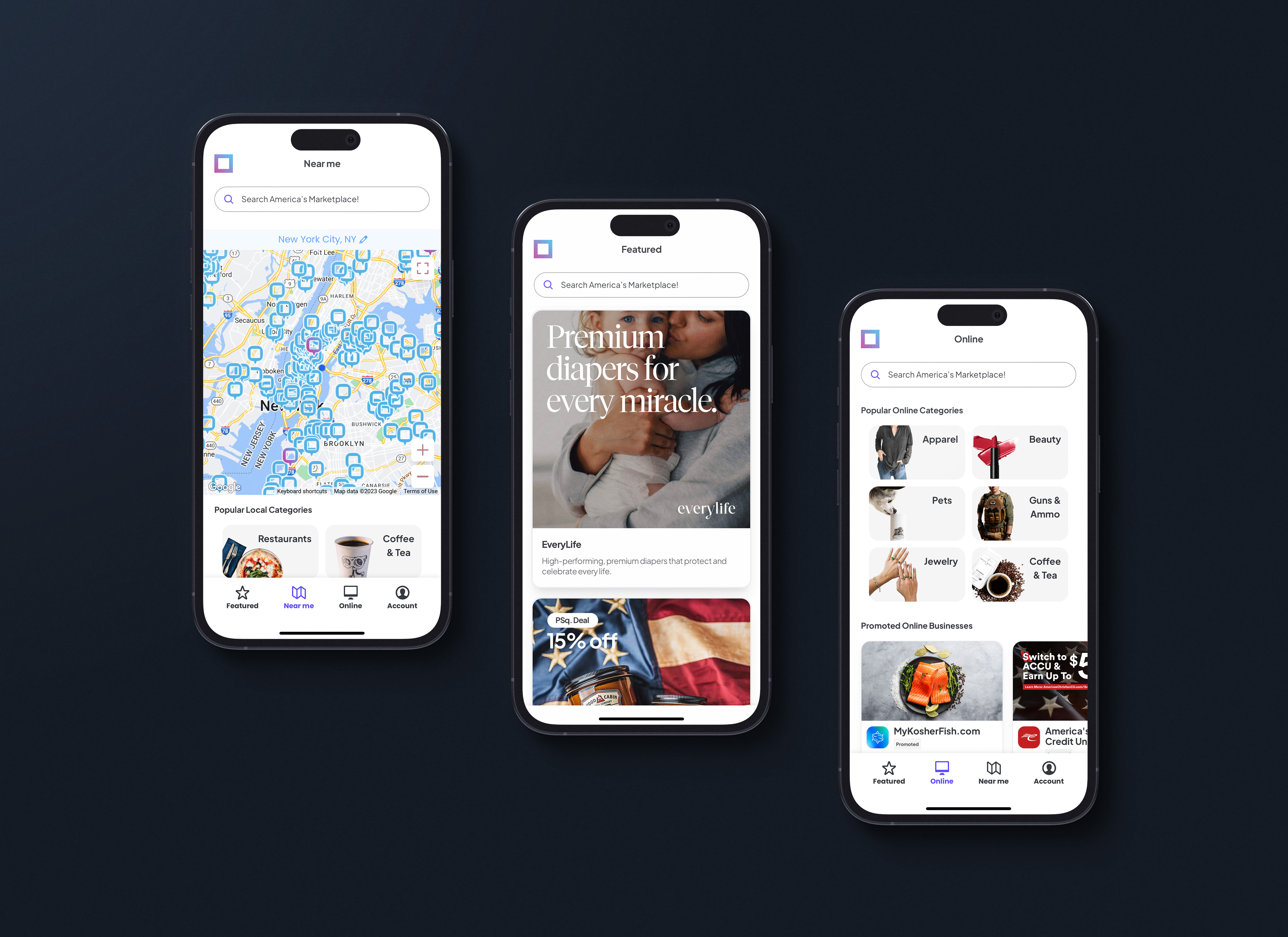

- Main business is PublicSq. (pronounced Public Square), a marketplace that matches values-focused consumers and businesses

- PublicSq. posts 1,144% revenue growth in first half of 2023

- Revenue growth outstripped expense growth in 2Q even in the face of one-time going-public costs

- IPO Edge interviewed CEO Michael Seifert to discuss the results and outlook

- Mr. Seifert told IPO Edge he does not expect a future capital raise to be necessary

- PublicSq. had 1.4 million members and 65,000 business on platform as of July 31

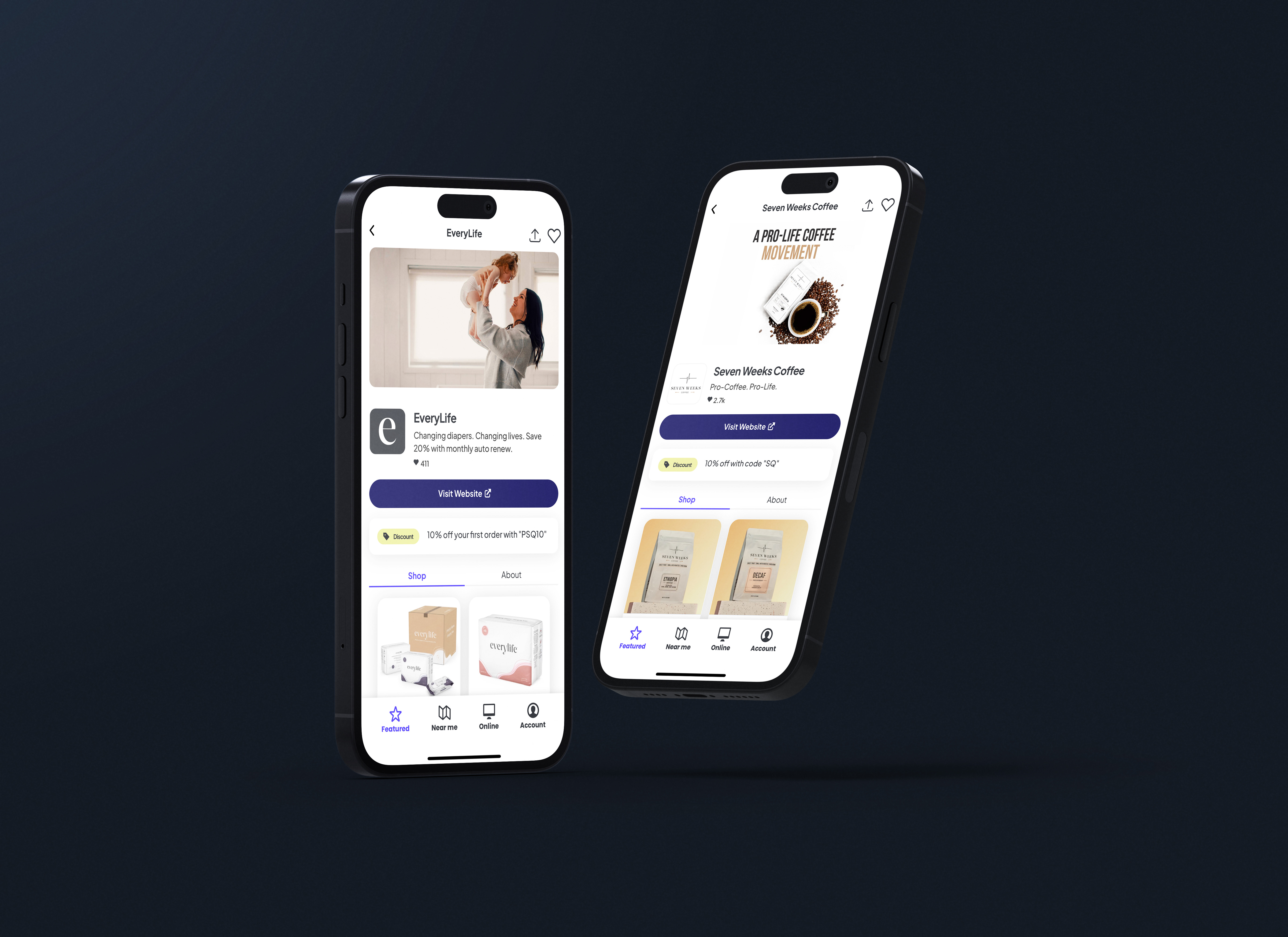

- New baby-care subscription brand EveryLife earned $300,000 of revenue in its first 19 days with 60% of orders on renewal

PSQ Holdings, Inc. (NYSE: PSQH), parent of marketplace PublicSq., posted a surge in revenue during the first half of 2023, with its CEO also flagging an expected swing to cash-flow positive next year.

“We have a compelling TAM, tools and capital to grow and there’s inherent leverage in this business,” Michael Seifert, Chairman and Chief Executive Officer of PublicSq. told IPO Edge in an interview Wednesday. He noted that the company has $32.6 million in cash on its balance sheet and doesn’t expect to need a capital raise.

PublicSq. was launched just over a year ago to help consumers “shop their values” in an environment that’s increasingly dominated by companies with so-called woke agendas. The company aims to help Americans find businesses selling everything from ribeye steaks to boat anchors. (IPO Edge hosted an hourlong interview with the company last month that can be viewed here).

In Wednesday’s interview, Mr. Seifert pointed out that the business is already showing signs of financial strength. Revenue grew faster than expenses in the second quarter over the first – even including many going-public related costs that are nonrecurring and unrelated to normal operations.

The business is growing quickly on both the consumer and business sides. It boasted over 1.43 million consumer members as of July 31, up from 1.20 million on June 30 and 385,000 on December 31, 2022. Vendors totaled 65,000 on July 31 versus 57,000 on June 30 and 32,851 at the end of 2022.

In recent news, the company launched EveryLife Inc., a wholly owned baby-care brand, on July 13 and generated $300,000 in its first 19 days. Importantly, 60% of the EveryLife orders are already set on auto-renew, a strong sign of consumer demand and commitment.

Mr. Seifert said he chose the baby category as the company’s first owned brand because values are of paramount importance when it comes to infant care. “There was no better place in which to get our toes wet,” Mr. Seifert said. “Our consumer cohort is most predominantly moms.”

He pointed to diapers as an area where EveryLife is already seeing great success. “We are already rivaling other diaper companies,” he said.

PublicSq.’s business model is similar to other digital marketplace platforms where vendors can pay fees for more prominent placement. The company doesn’t yet collect a “take rate” on orders, a common practice among major e-commerce players, which will be a brand new stream of revenue. The company has said it expects to launch such an e-commerce model this fall ahead of the Christmas shopping season.

PublicSq. stands out from many marketplace and e-commerce platforms because it has not only grown very fast but appears poised for profitability in the near term. Others such as Amazon grew quickly but took many years to turn a profit.

The PublicSq. app is free for both consumers and vendors, available on desktop along with Apple and Android devices. Activity on the app has surged recently, with an average of 453,225 per day for the month of July 2023, compared to an average of 89,843 unique sessions per day for the period from January 18, 2023 through January 31, 2023.

Contact:

Twitter: @IPOEdge

Instagram: @IPOEdge