- Pinstripes to merge with Banyan Acquisition Corp. (NYSE: BYN)

- Fuses upscale dining with bowling and bocce in “eatertainment” category

- 14 locations and 5 units under construction, with plans to add new venues

- Corporate clients make up about 50% of revenue

- Pinstripes trades at a steep discount to peers, roughly 17 times 2024 forecast Ebitda, far cheaper than Sweetgreen at 82 times consensus Ebitda or Cava at 49 times

- Outstanding leadership team, led by Founder & CEO Dale Schwartz, a Harvard MBA who previously worked in finance and pharmaceuticals

By Jarrett Banks and John Jannarone

A post-pandemic revival is boosting the food service industry. But diners want more than just the regular old night out, and a new category of “eatertainment” restaurants is fusing dining and sports to meet this demand.

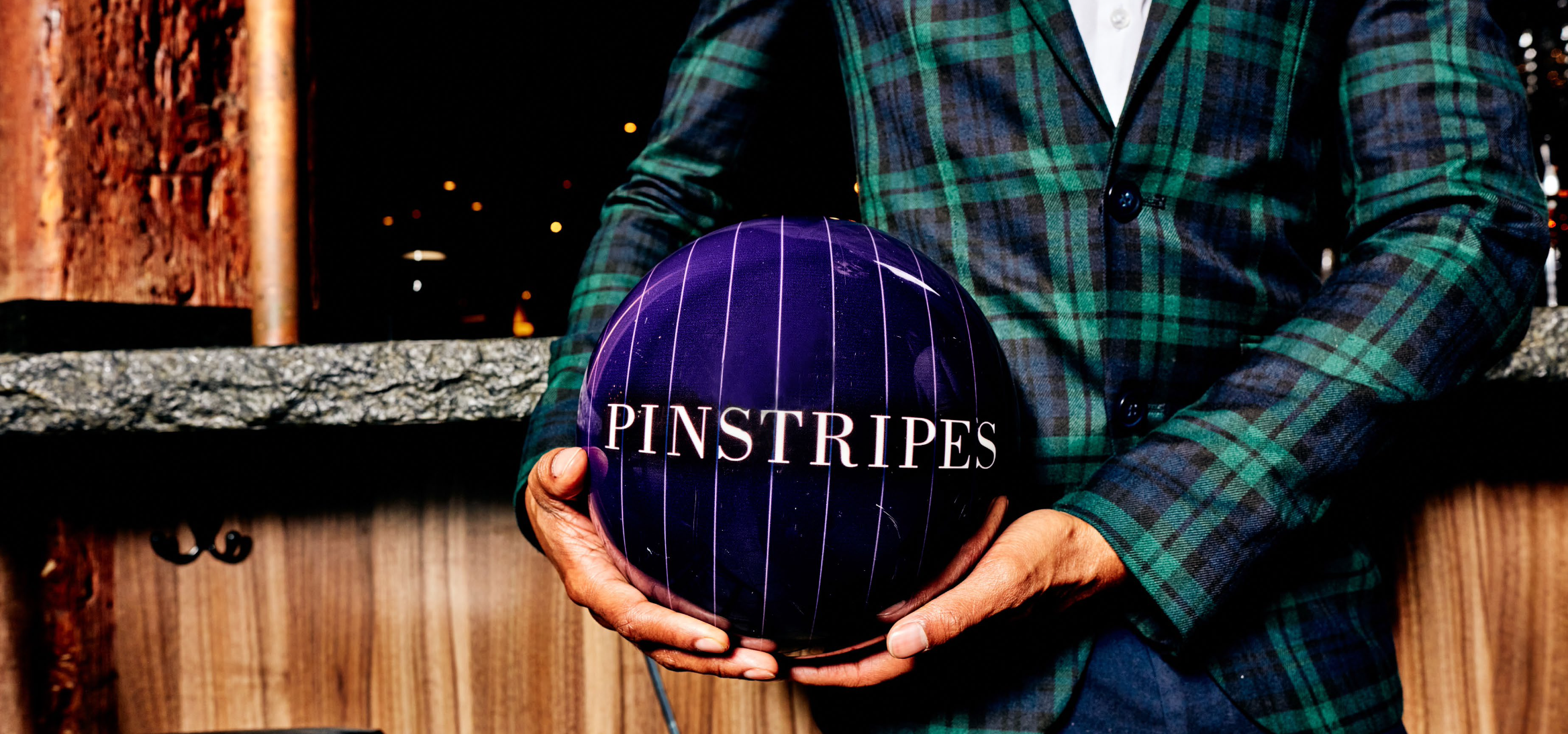

Meet Pinstripes Inc., which is merging with a special purpose acquisition company Banyan Acquisition Corp. (NYSE: BYN). Once the merger is finalized, the Northbrook, Il.-based company will list on the New York Stock Exchange under the ticker symbol PNST. The company offers activities such as bowling and bocce, making it an attractive destination for a wide range of patrons including corporate clients who make up almost 50% of revenue.

Unlike many companies that have gone public through SPAC mergers, Pinstripes is profitable. The company currently operates in 14 locations in the U.S., with an additional five venues under construction. Its newest location in Canoga Park, Ca., occupies over 30,000 square feet, introducing made-from-scratch Italian-American cuisine, fine wines and cocktails, bowling lanes, bocce courts and customizable private event and meeting spaces.

The company has an outstanding management team led by Founder and CEO Dale Schwartz, who previously ran a pharmaceutical company and had stints at Morgan Stanley and Odyssey Partners.

Mr. Schwartz grew up in Cleveland and loved to go bowling. The nostalgia and fun shared by family and friends during those bowling sessions ignited a dream that eventually led to the birth of Pinstripes in 2007. Pinstripes captures that nostalgia with its venues, Italian-American cuisine, service and classic games like bowling and bocce.

Pinstripes is aiming for a coast-to-coast presence with an estimated 150 locations on the horizon. This ambition is backed by a robust average new venue economic model that includes impressive cash-on-cash returns and quick payback periods.

The company is also focused on driving same-store sales growth through menu optimization, operational efficiencies, technology initiatives and an enhanced gaming mix.

Pinstripes has also excelled in Average Unit Volume (AUV), a key metric for comparing performance in the restaurant and entertainment industry. From FY2019 to FY2022, it achieved an impressive 32% growth in AUV, outperforming some prominent names in the industry.

From 2018 to 2019, the company expanded from 8 venues to 13, demonstrating a strong growth trajectory. The company is targeting 23 venues by December 2024.

Pinstripes has some serious advantages when it comes to securing the right real estate. First, it’s an ideal anchor tenant that attracts shoppers along with neighboring businesses that complement – rather than compete with – its entertainment and food offerings. That makes landlords eager to court Pinstripes as it chooses new locations.

What’s more, there are plenty of big boxes left behind by defunct or struggling retailers like Sears that only a few types of businesses can put to use. Landlords will even offer capital toward tenant improvements: To date, developers have provided more than $100 million in non-dilutive tenant improvement funding and invested another $40 million in Pinstripes itself.

Turning to financials, investors should be happy to see that Pinstripes runs a tight ship to ensure profitability. Rather then emphasizing store-level profits, the company keeps corporate expenses lean enough that most money can flow to the consolidated Ebitda line.

Indeed, Pinstripes forecasts $43 million to $45 million of venue-level Ebitda in 2024, with consolidated Ebitda of $28 million to $30 million. The company deliberately keeps centralized costs low for another reason: It’s more effective to have people working in sales and other relationship-based roles the locations themselves rather than in corporate roles in a large centralized office.

Investors should also categorize Pinstripes as a high-growth restaurant rather than an entertainment venue. Roughly 75% of sales at Pinstripes are food and beverage versus around 40% at Dave & Buster’s.

In turn, it’s smart to benchmark Pinstripes against some highly-valued restaurant operators. Pinstripes, at the current share price, trades at about 17 times 2024 forecast Ebitda. That’s far cheaper than Sweetgreen at 82 times consensus Ebitda or Cava at 49 times, according to estimates from Sentieo, an AI-enabled research platform.

With ambitious goals, a proven track record and a strong financial foundation, the company is charting a path toward continued success in the competitive worlds of entertainment and dining. Savvy investors will be able to see: Pinstripes is rolling nothing but strikes.

Contact:

IPO-Edge.com

Editor@IPO-Edge.com

Twitter: @IPOEdge

Instagram: @IPOEdge